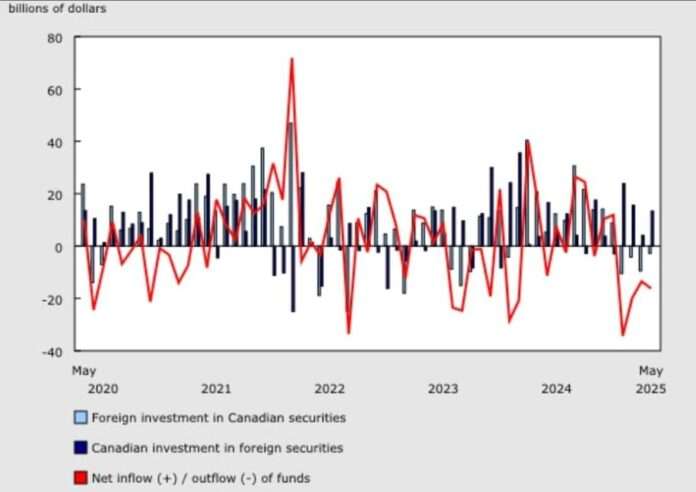

New figures from Statistics Canada reveal a shifting trend in investment flows, with foreign investors steadily reducing their holdings of Canadian securities while Canadians increase their investments abroad.

In May, foreign investors divested $2.8 billion in Canadian securities — marking the fourth consecutive month of net outflows. Notably, they shed $11.4 billion worth of Canadian shares, with the energy and mining, corporate management, and manufacturing sectors seeing the largest reductions.

However, foreign interest in Canadian government bonds rebounded, with investors acquiring $13.1 billion in May after divesting $25.1 billion in April. This included $8.0 billion in provincial bonds and $6.9 billion in federal government bonds, offset by a $4.2 billion reduction in private corporate bonds.

Despite the selloff in Canadian equities, the S&P/TSX Composite Index rose by 5.4% in May following three months of declines.

Meanwhile, Canadian investors expanded their foreign holdings by $13.4 billion — a sharp increase from $4.1 billion in April. They primarily targeted U.S. shares, purchasing $14.2 billion in May, though this was tempered by selling $2.8 billion in non-U.S. shares. Canadian investors also shifted their focus in foreign debt markets, buying U.S. corporate and non-U.S. bonds while cutting back on U.S. government bonds and Treasury bills.

This combined activity resulted in a net outflow of $16.2 billion from Canada’s economy in May — the fourth straight month of net outflows, totaling $83.9 billion over that period, according to StatCan.